your tax refund is the key to homeownership

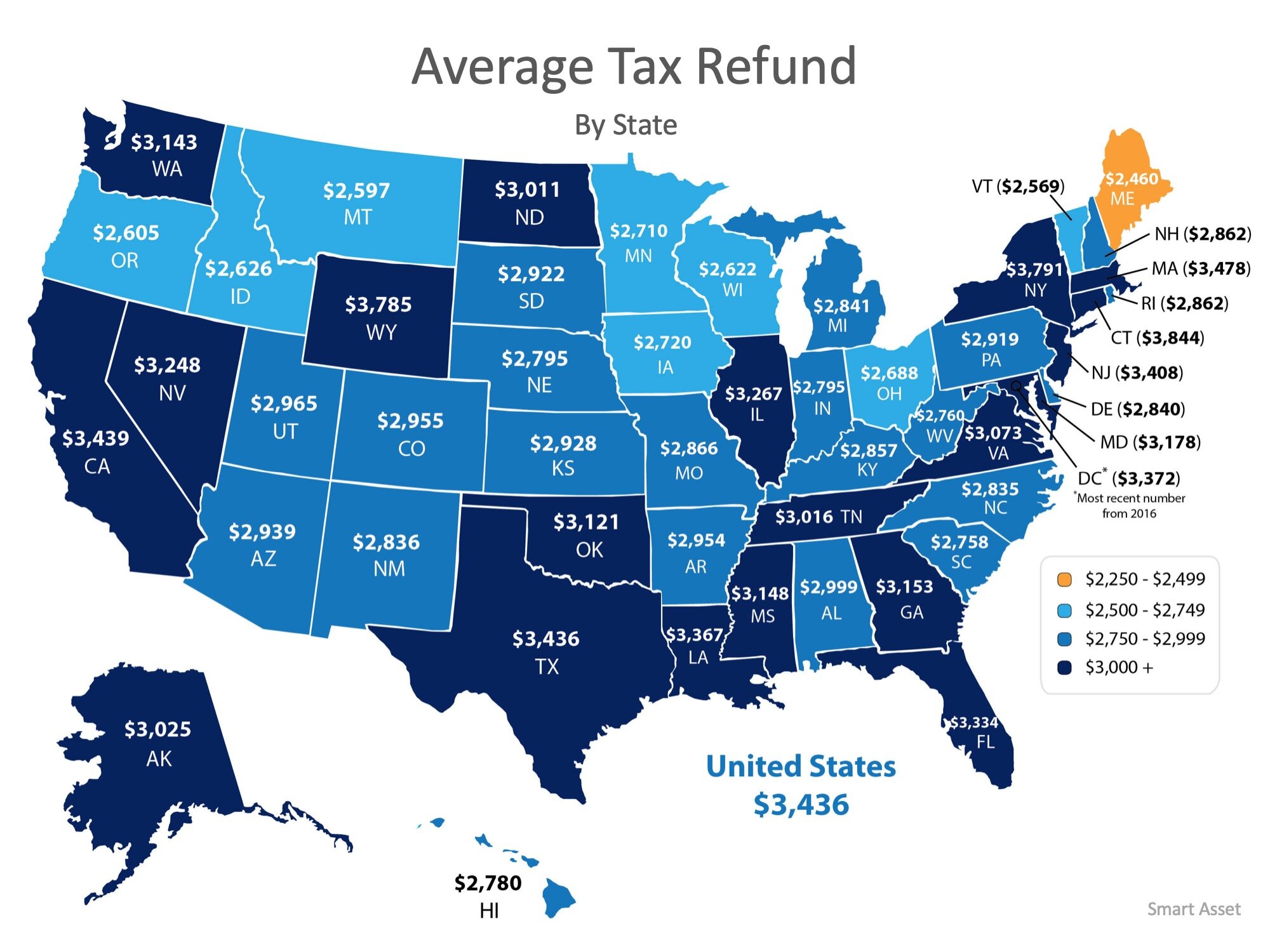

/Americans can expect an estimated average tax refund of $3,143 according to the IRS. This is down slightly from the average refund of $3,436 last year. Tax refunds can be considered extra money to use toward larger goals. For anyone looking to buy a home in 2019, this can be a great jump start toward a down payment!

The map below shows the average tax refund Americans received last year by state.

Many first-time buyers believe that a 20% down payment is required to qualify for a mortgage. Programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae all allow for down payments as low as 3%. Veterans Affairs Loans allow many veterans to purchase a home with 0% down.

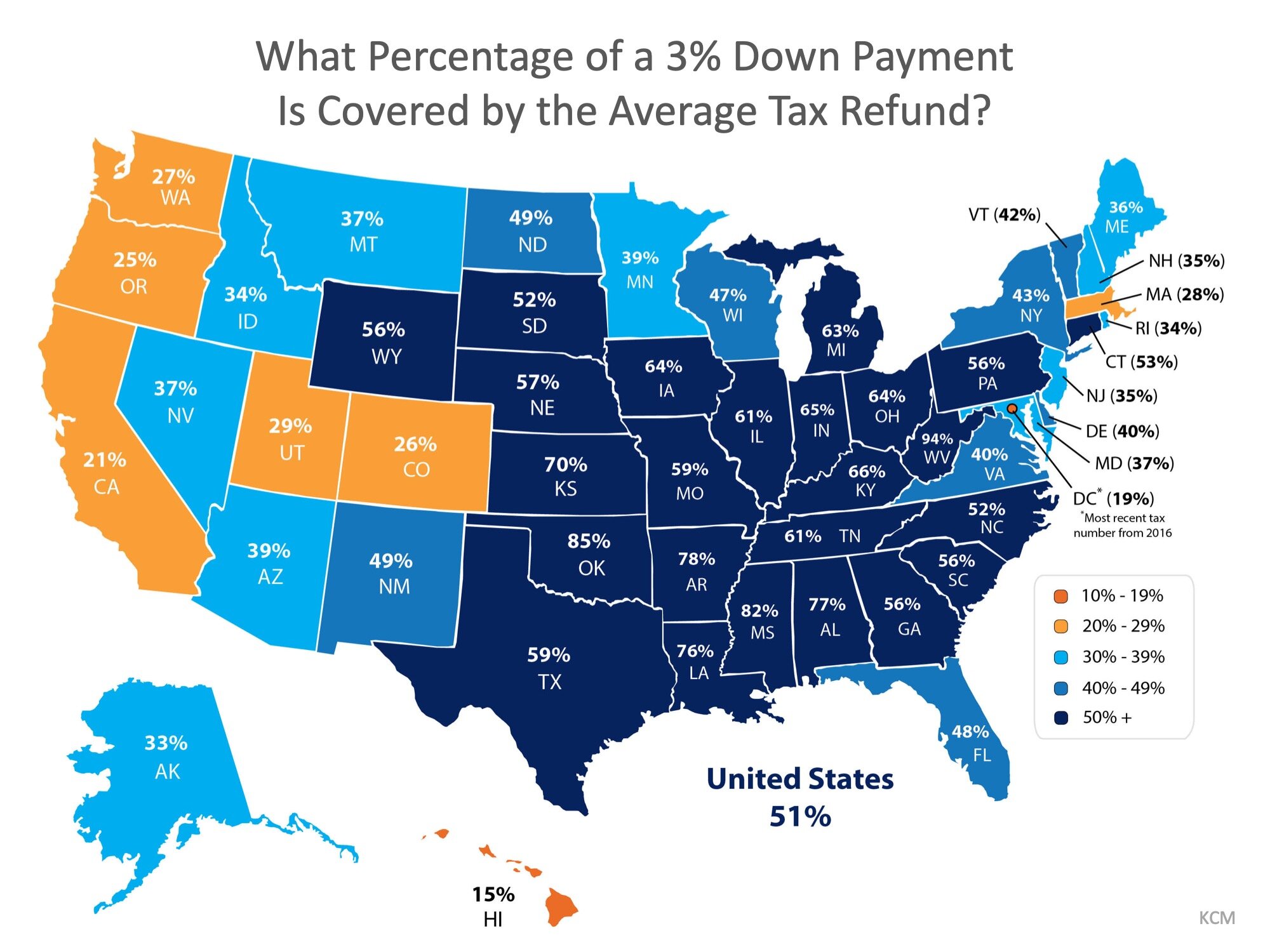

If you started your down payment savings with your tax refund, how close would you be to a 3% DP?

The map below shows what percentage of a 3% down payment is covered by the average tax refund by taking into account the median price of homes sold by state.

The darker the blue, the closer your tax refund gets you to homeownership! For those in Colorado looking to purchase their first homes, their tax refund could get them 26% closer!

Bottom Line

Saving for a down payment can seem like a daunting task. The more you know about what’s required, though, the more prepared you can be! This tax season, your refund could be your key to homeownership.